In financial terminology, a “haircut” generally refers to a reduction applied to the value of an asset when used as collateral, or more broadly, a discount from the stated value of something. It is most commonly used in lending, trading, and regulatory contexts. Here’s how it typically works:

Read MoreStepping into adulthood brings excitement, freedom, and a sharp turn toward responsibility. It’s the first real taste of managing your own life—your own roof, bills, career, relationships, and bank account. That’s where the thrill and pressure collide, especially when it comes to managing money and making smart choices. The good news? You don’t need to have it all figured out at once, but the sooner you start laying a solid foundation, the smoother the ride will be down the road.

Read MoreRelocating to a new country involves adapting to a new culture and mastering key survival skills, including bargaining and negotiation. Whether it’s for securing a comfortable living space or ensuring you’re not overpaying for services, effective negotiation skills can profoundly impact your living costs and overall experience in a new […]

Read MoreUnderstanding spending habits in the US and Europe reveals fascinating contrasts shaped by history, culture, and economics. This blog explores key differences in consumer behavior, economic influences, and the impact of these habits on both regions. By examining these contrasts, we can better understand how businesses, travelers, and policymakers can navigate these distinct markets.

Read MoreMoving to a new city is always an exciting adventure. Still, it comes with its own set of financial challenges and considerations, especially when moving to a higher-cost-of-living area. Often people moving to Florida are retiring and may be downsizing but many choose an expensive city in Florida, the transition can bring opportunities and expenses that require careful planning. In this blog post, we’ll explore the key financial aspects you need to consider to make your relocation as smooth and cost-effective as possible.

Read MoreSplitting Your Golden Years:

Planning for retirement can be complex, especially for those who dream of spending their golden years between the United States and another country. As an immigrant or expat, this unique lifestyle choice introduces several considerations beyond traditional retirement planning. Understanding the nuances of managing finances, healthcare, and legal obligations across borders is crucial to ensuring a smooth and enjoyable retirement.

Home-Buying Guide for Newlyweds

Ultimately, buying a home is an exciting yet often overwhelming process. But with the correct information and planning, you’ll find the perfect home to start your married life and build your family.

Smart Ways to Save for a Rainy Day Fund

Having a rainy day fund is essential for financial security. It helps cover unexpected expenses, like car repairs or medical bills, without disrupting your budget. Unlike an emergency fund, which serves major life changes, this fund is for smaller, unforeseen expenses. So, let’s learn smart ways to save for a rainy day fund and help you build a robust financial cushion.

The Importance of Financial Wellness Programs in the Workplace

In today’s fast-paced and increasingly complex world, the traditional notion of compensating employees solely through their salaries is becoming outdated. While a fair wage remains a cornerstone of job satisfaction, more employers recognize the need to support their workforce through comprehensive financial wellness programs. These programs extend benefits that go beyond mere monetary compensation, addressing the holistic financial well-being of employees. This article delves into the importance of financial wellness programs in the workplace, highlighting their numerous benefits and their positive impact on staff members.

How Moving to a New Place Impacts Your Spending Patterns

Moving to a new place can significantly alter your financial habits and spending patterns, especially when major decisions like buying a house affect your finances. This article aims to explore the diverse ways in which relocating impacts your budgeting and financial management. From initial moving costs to long-term changes in the cost of living, understanding these financial shifts is essential. Discover practical tips on how to adapt and manage your finances wisely in your new environment.

The “Ins and Outs” of Energy Efficient Windows

Choosing energy-efficient windows can offer immediate and long-term benefits. They can enhance the comfort and aesthetics of your home, lead to significant savings on your energy bills, and contribute to a healthier environment. With this guide, you’re equipped to start your window upgrade process. Consider your local climate, your style, and available incentives, and remember the importance of proper installation and maintenance.

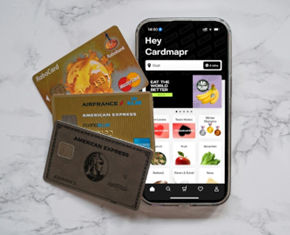

How to Effectively Manage Credit Cards as a Homeowner

Knowing how to effectively manage credit card debt as a homeowner will empower you to take charge of your finances. As a homeowner, your financial responsibilities extend beyond mortgage payments to include managing expenses, budgeting for maintenance, and planning for unexpected costs. So, you can’t overlook such an important contributor to your overall financial stability and flexibility.

What are “Moving Loans” and Do You Need One?

Moving loans are personal loans specifically designed to cover the costs associated with moving. That includes expenses like hiring moving companies, renting trucks, buying packing materials, and sometimes even covering deposits for new rentals. Unlike auto or home loans, these are typically unsecured, meaning they don’t require collateral.

Navigating Currency Exchange: Maximizing Your Money When Moving Abroad

When you’re planning an international move, navigating currency exchange becomes necessary. So, let’s go over the complexities of the process, provide practical insights, and equip you with the knowledge needed to make solid financial decisions!

The True Cost of Neglect: How Deferred Home Maintenance Creates Money Pits

Have you ever wondered how deferred home maintenance creates money pits? Beyond the surface, there lies a web of hidden costs and consequences that homeowners often underestimate. In this journey, we’ll uncover the true extent of these financial burdens, emphasizing the importance of proactive home care. Discover how vigilance today can save you a fortune tomorrow

Financial Factors to Consider When Relocating Your Business

When contemplating a business relocation, financial factors take center stage. From estimating relocation costs to understanding tax implications and assessing market dynamics, every decision carries consequences. So, let’s explore critical financial factors to consider when relocating your business you need to navigate, ensuring a well-informed and sound transition.

Nomad Living: Managing Finances for a Mobile Lifestyle

The allure of exploring diverse cultures, experiencing new environments, and embracing the freedom of nomadic life is irresistible to many. However, managing finances effectively remains critical for expats with a mobile lifestyle,