If you’re like most people, chances are you have at least one credit card that you use to purchase stuff like clothes or tech. Maybe you have a good credit score, and you can afford to make bigger purchases like vehicles or houses.

Unfortunately, missing payments can drastically affect your credit score. You can’t just skip a payment or two, thinking that it won’t affect you or because you are just forgetful.

What Is a Credit Score?

Simply put, a credit score is a number between 300 and 850 that shows your creditworthiness and how likely you are to pay off a loan on time. It’s based on your credit history and calculated using the information on your credit reports. About 90% of lenders use FICO Scores to decide whether they’ll lend you the funds.

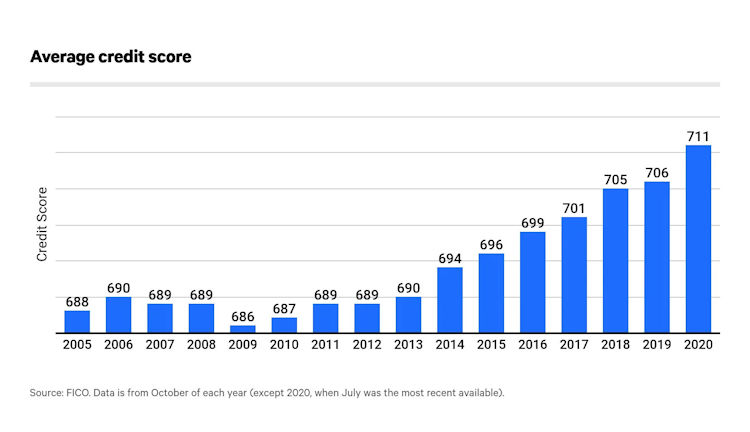

The higher the number, the better your credit score is. The average FICO credit score in the US has increased over the years it was only 688 in 2005 and in 2020 it was up to 711.

Naturally, this number varies, and your credit score is affected by:

- Age

- Income

- Credit history length

- Payment history

Credit Score and Family Life

Even though your credit score is unique to you, your family may still feel the consequences of your credit score. Here’s how.

Credit Score Can Affect Your Child’s Education

Education is an expensive investment, but it’s the best one for your child. Chances are you’ll get a loan to fund your child’s university education. With a good credit score, you’ll have no problem getting a loan.

However, if you don’t pay attention to your financial habits, you might not be eligible for a loan. Unfortunately, in that case, your child would have to pick a different school or find alternative ways to fund their education.

It Affects How You Pay Medical Bills

There’s nothing worse than being ill. Unfortunately, medical treatments are expensive, especially if you have to stay in the hospital. You might think that your insurance will cover your medical bills, but that’s not always the case.

You probably have some money saved for rainy days, but that’s intended for the worst-case scenarios. All in all, you’ll have to spend those savings to pay your medical bills out of pocket if you have a poor credit score and you can’t get loans. This will overburden your household and leave your family without savings.

It Might Cost You a Car or a Home

Another example of your credit score affecting the lives of your family members is the moment when you decide to purchase a car or a house. These types of purchases require that you sign a long-term contract with a financial institution.

Depending on your credit score, this can be an easy or a challenging situation. Your poor credit score will directly affect your ability to purchase a car or a home and upgrade your family life.

What About Marriage and a Bad Credit Score?

When you get married, your premarital debt belongs only to you. The same goes for your spouse. However, if you co-sign a loan with your spouse, it will affect both of you. Any instances of late or missed payment will reflect in both individual credit score reports.

If any of you decide to make a bigger purchase, the lenders will check both credit scores and might see a missing or late payment. This will most likely result in a declined loan for both of you.

What If You Guarantee for Your Child?

If you decide to help your child out and guarantee that their student loans will be paid off, you need to be careful. On the one hand, your support will mean a lot to your child and possibly teach them how to remain financially responsible so that they don’t cause an issue for you.

Still, if you or your child can’t make payments on time, their debt will be treated as yours as well. This can directly affect your credit score and cause long-term problems in other areas of your life.

How to Improve and Maintain a Good Credit Score

If you have faced these problems before, you know how important it is to maintain and improve your credit score. Luckily, there are ways to do that.

Regularly review your credit report using the official Annual Credit Report website. Take the time to analyze each report and see what might hurt your score.

Since most lenders use FICO Scores, and payment history is the crucial factor with the biggest impact on your credit score, make sure that all your loans are already paid off. To prevent being late in the future, use a mobile app or set up automatic payments.

If you can’t always pay your credit card balances in full, try to keep your total outstanding balance at 30% or less. Then, you can work it out and make it 10% or less, which is ideal for achieving a better credit score.

Use credit monitoring services to help you keep track of your credit score changes. These services are usually free. They monitor the changes in your credit reports and give you access to at least one credit score report with the option to set up alerts to prevent fraud.

If your spouse has a poor credit score, but you manage to keep yours high, make sure to pay all bills on time to improve that score. You can also authorize your spouse to use your credit card that has a good payment history.

Monitor your old accounts and everything that’s linked to them. Sometimes closing an old account is a good way to improve your credit score. Also, make sure to remove people who appear on your credit reports but are no longer connected to you or your address in any way.

Summary

Maintaining a good credit score allows you to purchase almost anything you want. Since your credit scores and reports are only in your name, you might think your family won’t be affected if you miss a payment. Unfortunately, there are some consequences to consider.

Your poor credit score will negatively impact your ability to pay your child’s tuition, medical bills, or buy a new car. Luckily, you can do many things to keep your credit score high and help your spouse do the same so that both of you can secure your family and live a better life.

You might also like: