In a secured loan the borrower pledges something of value such as a car, real estate or even jewelry as collateral for the loan. If the borrower defaults, the creditor can foreclose on the asset and take possession of the collateral. At that point he may dispose of it as he chooses in order to regain some or all of his loses on the loan.

A typical example, would be in the foreclosure of a home. During the housing bubble from 2000 through 2008 lenders were extending loans at a frantic pace to borrowers who were not necessarily credit worthy. But the banks believed that the loans were secure because housing prices were going up so if they had to foreclose on the property they could sell it for more than was owed on it due to the rapidly increasing housing prices. Thus mortgage lenders became speculators in the housing market as well.

A typical example, would be in the foreclosure of a home. During the housing bubble from 2000 through 2008 lenders were extending loans at a frantic pace to borrowers who were not necessarily credit worthy. But the banks believed that the loans were secure because housing prices were going up so if they had to foreclose on the property they could sell it for more than was owed on it due to the rapidly increasing housing prices. Thus mortgage lenders became speculators in the housing market as well.

What if the Security Doesn’t Cover the Value of the Debt?

However, if the sale of the foreclosed property does not raise enough money to cover the balance due on the debt, depending on the terms of the the loan, the creditor may be able to obtain a deficiency judgment against the borrower for the remaining amount. However, some contracts limit the borrowers liability to the value of the collateral these are called non-recourse loans.

Non-Recourse Loans

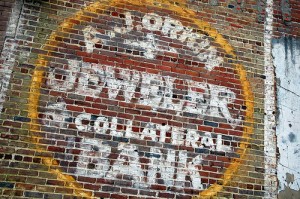

In many developing countries, the use of collateral is the primary way to secure financing. And the basic idea behind a “pawn shop” is the use of this principle. Thus the shop will lend based on its estimation of the value of personal property such as jewelry, cameras, laptops, etc. If the borrower does not redeem his pledge within a certain period of time the pawn shop takes ownership. (Although pawnshops also buy used items outright and avoid the waiting period.) Both of these are examples of non-recourse loans the lender can not go after any other property of the borrower except the property specifically given as collateral.

Secured Loans and Art

The main purpose for a secured loan is to relieve the lender of most of the financial risks involved because it allows the for recovery based on more than just the borrower’s willingness and ability to pay. A recent trend has developed to allow for using financing for the purchase of art. In the case of bank financing often the buyer can retain possession of the work of art while payments are being made or in the case where the lender is a gallery often the gallery will retain possession until payment in full has been made. See The Pros and Cons of Art Financing for more information.

An advantage of secured loans for the borrower is that the creditor may offer better terms (i.e. interest rates and/or repayment periods) because his risk is lower.

Types of Secured Loans

- A mortgage loan is a secured loan in which the collateral is property, such as a home.

- A nonrecourse loan is a secured loan where the collateral is the only security or claim the creditor has against the borrower, and the creditor has no further recourse against the borrower for any deficiency remaining after foreclosure against the property.

- A foreclosure is a legal process in which mortgaged property is sold to pay the debt of the defaulting borrower.

- A repossession is a process in which property, such as a car, is taken back by the creditor when the borrower does not make payments due on the property. Depending on the jurisdiction, it may or may not require a court order.

How to Create Secured Debt

Debt can become secured by a contractual agreement, statutory lien, or judgment lien. Contractual agreements can be secured by either a Purchase Money Security Interest (PMSI) loan, where the creditor takes a security interest in the items purchased (i.e. vehicle, furniture, electronics); or, a Non-Purchase Money Security Interest (NPMSI) loan, where the creditor takes a security interest in items that the debtor already owns.