Bankruptcy is designed to help people who are struggling to pay their bills. While there are negative consequences to filing for it, there can also be many positive consequences as well. Ideally, you will know why you want to file and what steps that you will take after filing to get through it stronger than before.

Know Why You Filed

While filing for bankruptcy can eliminate some or all of your debts, it won’t help you make better financial decisions in the future. Therefore, you have to determine why you filed and how to avoid doing so again. For instance, if you spent too much money on clothes or lottery tickets, it will be worthwhile to reduce or eliminate how much is spent on those luxuries.

Know Where to Find Help

If you are struggling to change your financial habits, it can be a good idea to reach out to a financial adviser. This person can help you create a budget, learn more about concepts such as compound interest and otherwise make it possible to increase your fiscal competence. You can also talk with an attorney to learn more about how it will impact your finances over the short and long-term.

Get a Secured Credit Card

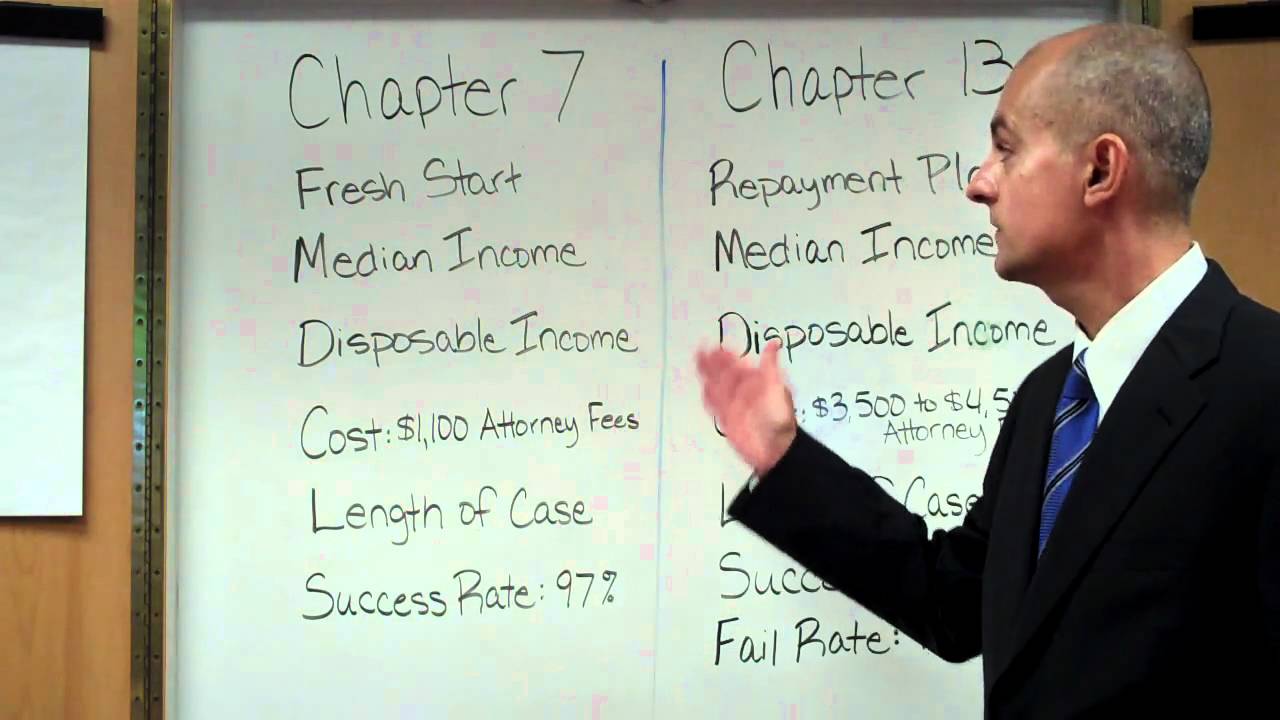

After your debts have been discharged, be sure to get a secured credit card to start rebuilding your credit. This is true whether you file for Chapter 7 bankruptcy or Chapter 13. Ideally, you will use it to pay for gas or other daily expenses with the expectation that the balance is paid in full at the end of the month. This will help to improve your credit score and make it easier to get traditional credit cards in a timely manner.

Keep an Eye on Your Credit Reports

It is possible for credit agencies to report balances on accounts that have been wiped out in bankruptcy. If your report does have inaccurate information on it, that could have a significant impact on your credit score. Challenging erroneous details could result in your score going up dozens or hundreds of points. You have the right to obtain one free copy of your credit report per year.

Filing for bankruptcy should be a last resort for those in financial dire straits. However, if you need to take that step, it is important to know that there is a way to recover from bankruptcy. In fact, by eliminating your debt, it may be easier to start saving money and strengthening your financial position.

You might also like:

- How to Handle Medical Bill Debt

- How to Navigate Through the Emotional Baggage of Bankruptcy

- Personal Finance Strategy: 4 Keys to Avoiding Bankruptcy

- 6 Budgeting Pointers to Get Your Finances Back on Track

- Debt and Inflationary Pressures: A Lesson in Economic Interactivity

- How Does Your Debt Compare?

- Avoid the Car Debt Trap

You made a great point about knowing where to find help and possibly getting a financial adviser that can help you get a budget in addition to helping you learn more about concepts. My husband’s friend Cory recently told us he needs to file for bankruptcy and he asked us to help him find tips on how to get through it. We will pass these tips on in addition to finding a professional who can help Cory out.