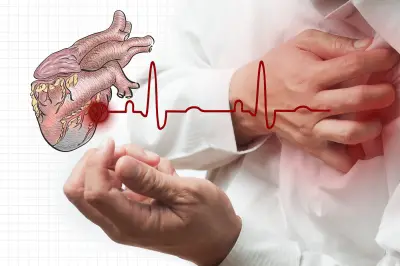

Health insurance covers medical expenses, including regular office visits. Thus having health insurance can encourage people to attend the doctor more regularly. As a result, medical professionals can perform early testing and catch various conditions soon enough to be treatable. Therefore, it is crucial to find a good plan and maintain coverage, regardless of your age. Below are some tips to consider when shopping for health insurance.

Research and Compare

When selecting a plan, it is always an excellent idea to compare it with other options before making a choice and paying any fees or signing agreements. By researching quality plans and speaking with representatives about any questions you have, you will have the confidence you need to make the best selection. In many cases, researching and comparing options will lead to cost-effective decisions regarding copayments, specialist services, prescription details, and more.

Perks and Benefits

Many individuals are under the misconception that you can’t find deals and perks with a health insurance plan, but that assumption is false. Some providers will not only offer discounts to use businesses and organizations that offer services and products to boost your health, but insurance companies also give you perks for staying in good health. For instance, signing up for the gym and working out, or taking up exercising habits like walking regularly, could lead to gift cards and other rewards from your provider. Always ask about these perks before selecting a policy.

Understand your Network

The type of doctors and specialists covered in your network is essential for choosing from optimized health plans. If you have a family physician that you are comfortable with, look for policies that include this medical provider in its network. Failing to do so could lead to out-of-pocket expenses. You can also change primary care physicians, but you will need to research and find the doctor that suits your needs and comfort levels the best.

Look for Tax Credits

Many people are unaware of the discounted plans they can receive due to annual tax credits. Instead, they miss out on the savings and continue paying expensive costs. It is essential to see what credits you qualify for and use them when paying for your health insurance policy. The money saved can be spent on other necessities, such as food, utilities, school expenses, or to add to your savings. Open enrollment for “ObamaCare” begins on November 1st and depending on your income can save you thousands of dollars a year. Just go to HealthCare.gov to see if you qualify.

Health insurance helps you cover the costs if you get sick, and it can provide care that prevents many illnesses and medical conditions. Therefore, you should use these tips when shopping for quality health care insurance.

You may also like: